EDUCATION AND RESOURCES

FOR YOUR JOURNEY TO

TRADING SUCCESS

TRADER TAXES

Traders and active investors have unique challenges preparing their taxes, and most information found on online is misleading or simply incorrect. Brokerages offer little or no guidance in this area. So, we put together these resources and trader tax guides to explain in clear, simple language the issues facing traders and investors at tax time.

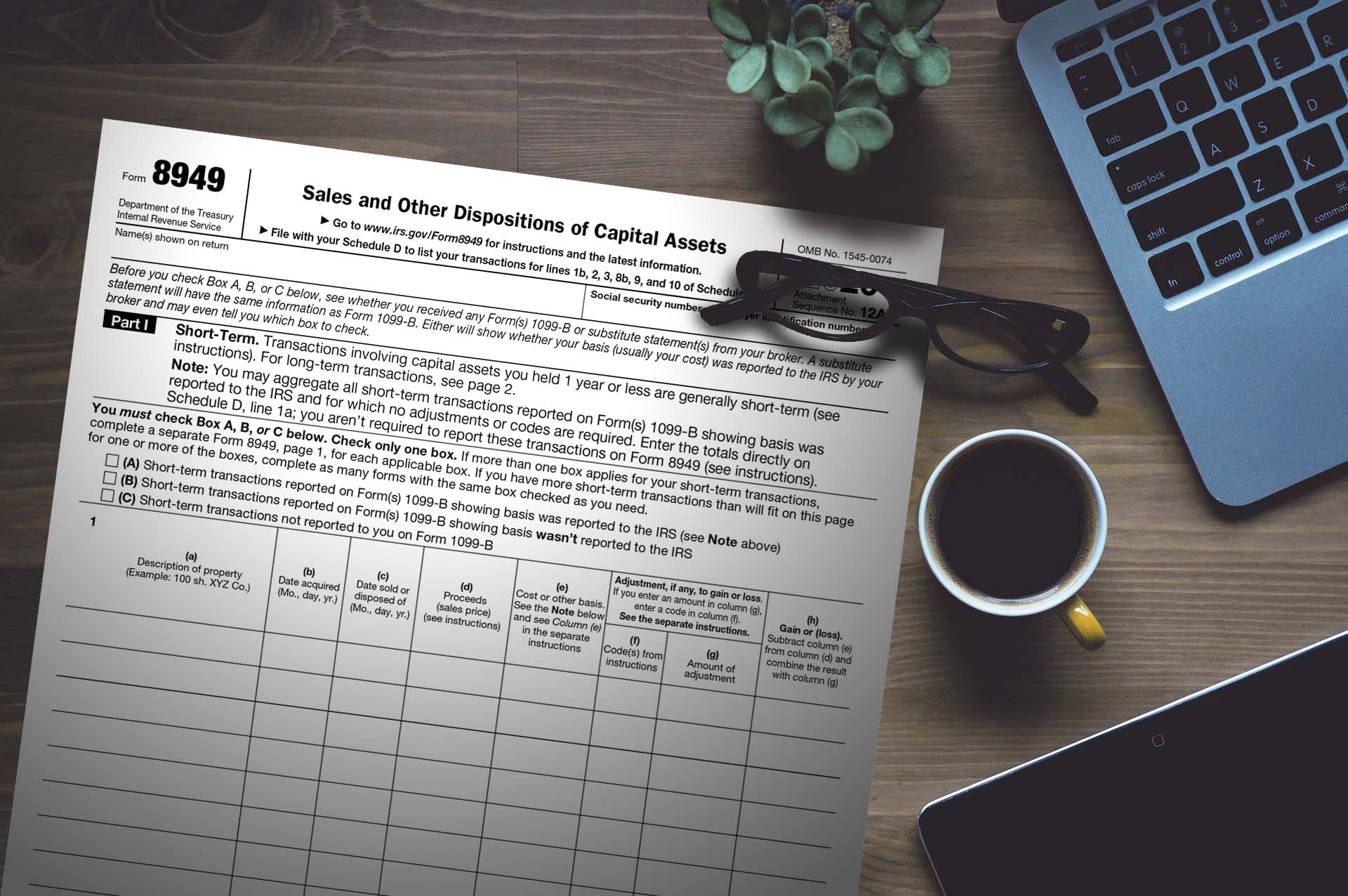

Learn the purpose of Form 8949 and Schedule D. Find out how to accurately produce these tax reports for capital gains and wash sales.

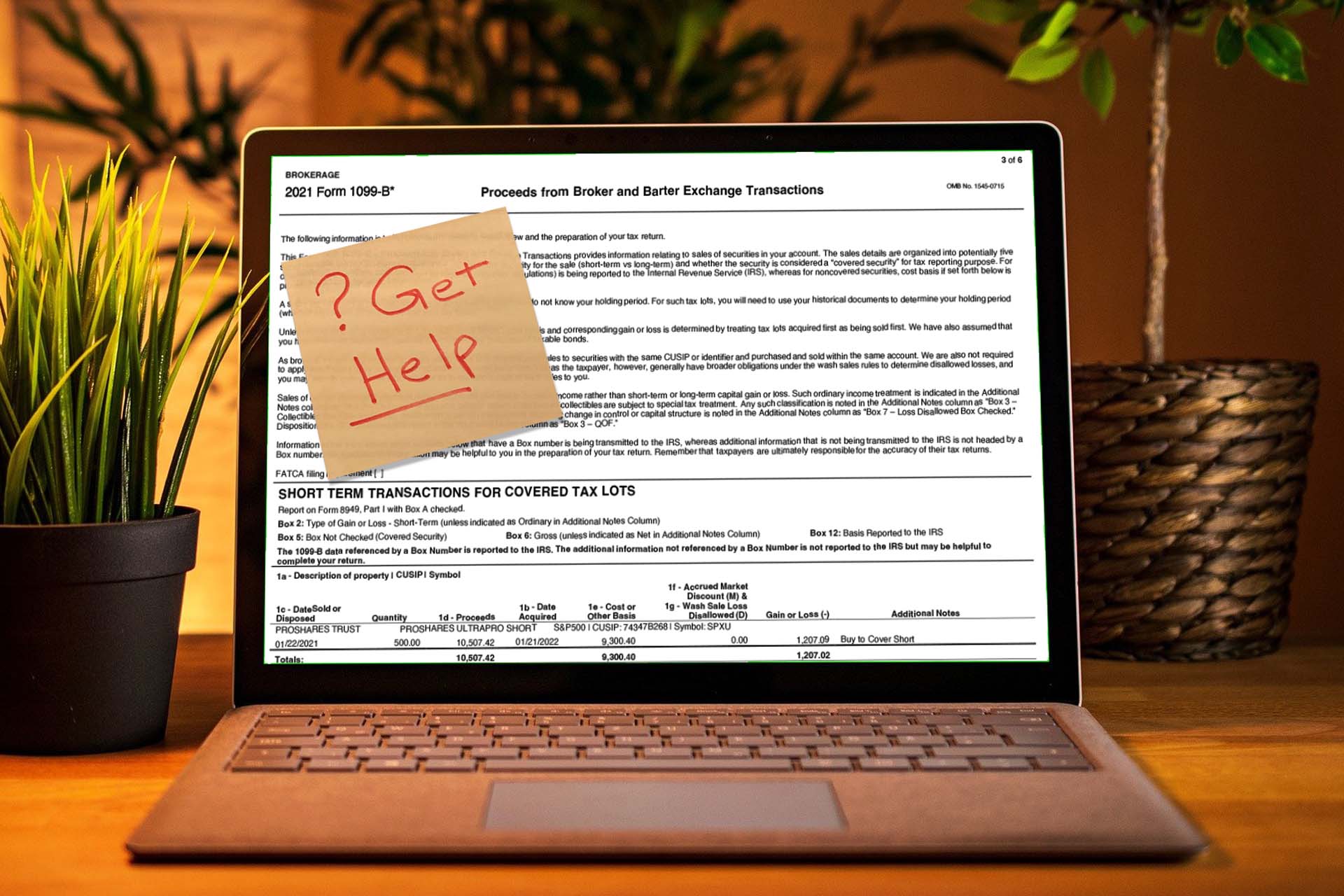

See why most traders and active investors cannot rely on 1099-B alone for tax reporting. We’ll explain what’s reported and why it’s often inadequate.

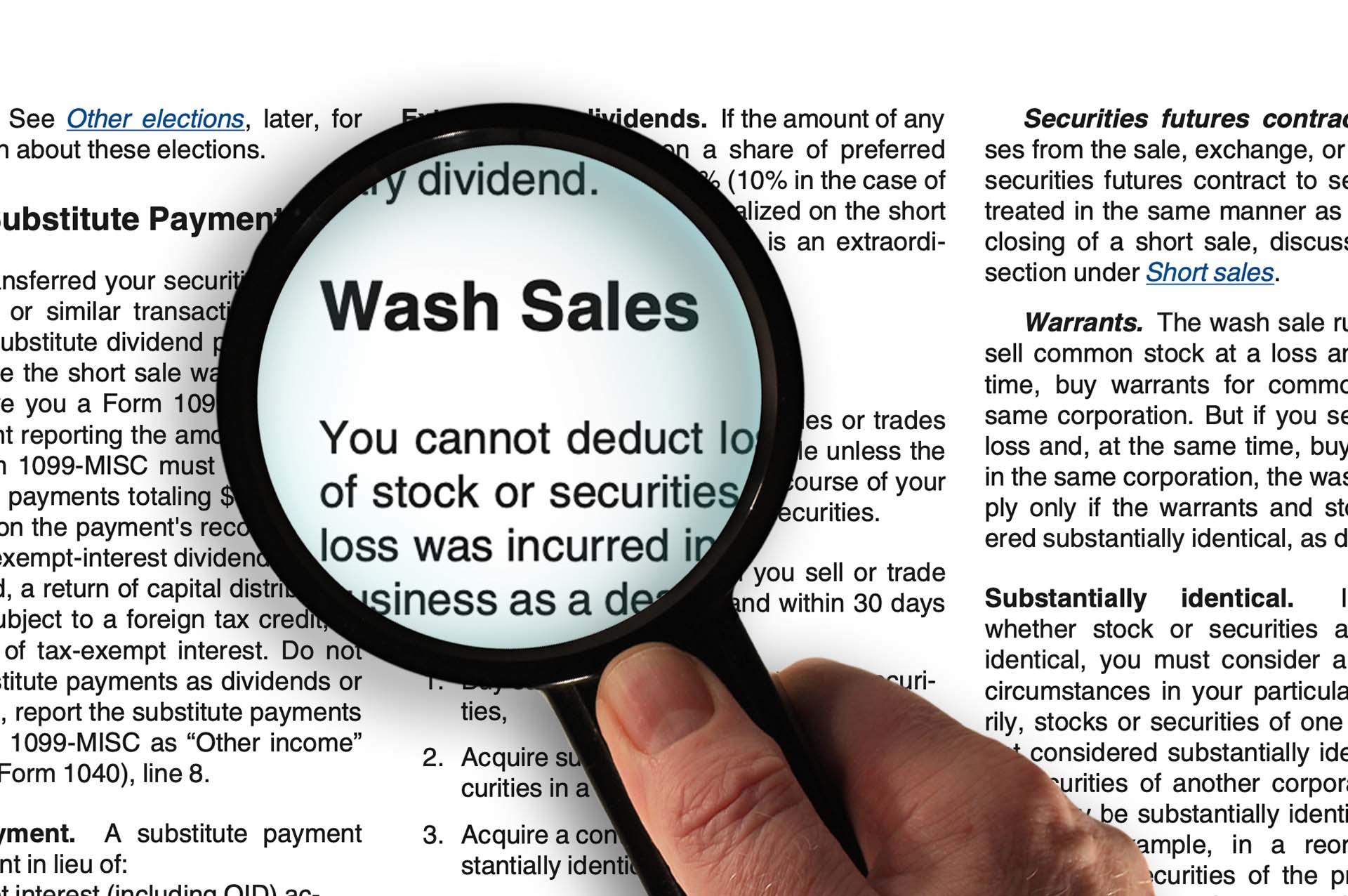

Understand the wash sale rule and how it affects your trading and investing. Learn how traders take control of wash sales to minimize potentially harmful tax results.

Is Trader Tax Status for you? Learn what’s involved in the Section 475f election and mark-to-market accounting. Understand how to report Form 4797 for gains/losses.

Read about special tax rules and adjustments required for options trading when sold, expired, or exercised.

Understand tax treatment for exchange-traded funds and notes. Learn what to do if you receive a K-1, and about volatility products.

Futures and other qualified Section 1256 Contracts can benefit traders with often-preferred tax treatment, learn more.

Crypto has been a hot market and taxation is quickly evolving. Learn what traders need to know about virtual currency tax reporting.

TRADER SUCCESS

Successful trading doesn’t happen by chance. Acquire knowledge, skills, and tools that can help you.

TRADELOG EVENTS

We offer free educational events – live and recorded – to help you gain insights on every phase of your trader journey of learning.

TRADELOG BLOG

Read our latests posts and stay up-to-date on news and topics for trader taxes and education.

- Secure Trade History AggregationAt the heart of TradeLog lies the ability to import trade history from multiple brokers and aggregate that data in a consistent format. We’re introducing our next generation BrokerConnect feature, powered by SnapTrade.

- Secure Trade History Aggregation

- Traders Ask: Can I Use My 1099-B? Here’s a free tool to find out.

- Filing a Tax Extension – What Traders Should Know

- Trader Tax Deadlines: 2024

- Are Wash Sales Affecting Your Bottom Line?

- Trader Tips: Why You Need a Trading Computer

- Trader Tips: Succeeding as a New Trader

- Surviving the Tax Season – The What, Why and How of Corporate Actions

- The TradeLog Top Ten

- How Keeping a Log of Your Trades Makes You a Better Trader

- Afraid to Trade? Expert Tips on How to Get Started