CRYPTOCURRENCY TAXES

A TRADERS GUIDE TO CAPITAL GAINS TAX ON VIRTUAL CURRENCIES

CRYPTOCURRENCY TAXES

A TRADERS GUIDE TO CAPITAL GAINS TAX ON VIRTUAL CURRENCIES

Bitcoin, Ethereum… the crypto market has exploded in recent years and all that attention hasn’t gone unnoticed by tax authorities. While calculating capital gains on crypto trades is fairly straightforward now, change is in the air and traders need to be aware, and prepared.

CONTENTS

WHAT IS CRYPTOCURRENCY?

Cryptocurrency is a digital cash system without a central entity (decentralized). As a result, it is immune to government interference or manipulation and difficult to counterfeit, and new systems can also be created at any time. Cryptography is used for chaining together digital signatures of asset transfers and creating an online ledger of all transactions, known as a “blockchain”. Cryptocurrencies are secured by math, not people or trust. According to CoinMarketCap, there are 17,055 cryptocurrencies available as of January 2022. By market capitalization, the largest blockchain networks are by far Bitcoin, and Ethereum.

There are a few rules that most cryptocurrencies usually follow: Transactions are irreversible. Your money is not FDIC insured. If funds are sent to the wrong person, there is likely nobody in the world that can get them back for you. Cryptocurrency also provides anonymous ownership; its usually not possible to link an account or transaction back to a real identity. Transactions are confirmed nearly instantly whether sent across the street or across the globe. Security is tight, using a public key cryptography system that is nearly impossible to break. Since you don’t need to apply for an account, run a credit check, get permission, or sign your life and firstborn away, it is very easy to start sending and receiving cryptocurrency.

TAX TREATMENT FOR CRYPTO

The IRS treats “convertible virtual currency” as property, just like stocks or real estate.

“Convertible virtual currency” constitutes any virtual currency that has an equivalent value in real money or can be used as a substitute for real money, and is exchangeable for legally recognized tender. Most of the major cryptocurrencies, like Bitcoin for example, act as a “convertible virtual currency”, and as such, they are subject to capital gain or loss and investment income tax treatment and associated reporting requirements.

Traders who invested in cryptocurrency, selling, exchanging, or spending, must report a capital gain or loss of each transaction – realizing as either short-term or long-term gains/losses. This includes purchases of good or services using cryptocurrency.

Using Crypto Creates Capital Gains Taxes

So you don’t “trade” crypto, but you use it for goods or services… Surprise, this creates a capital gains tax liability! The value of the goods, services, or real currency you receive in exchange for your cryptocurrency determines whether you have a capital gain or loss in these exchanges. That value, in essence, becomes the “sale” value for the cryptocurrency. If the value is more than the cost basis of the cryptocurrency used, then you have a capital gain; if less, than you may have a capital loss.

Let’s Consider an Example: You acquired one (1) Bitcoin on February 1, 2013 in exchange for $1,000 USD. On February 1, 2022 you are able to buy a new car using your one (1) Bitcoin as your payment. What are the tax implications?

- First, we determine the basis of the Bitcoin purchased. The IRS says: “Your basis (also known as your “cost basis”) is the amount you spent to acquire the virtual currency, including fees, commissions and other acquisition costs in U.S. dollars.” In this case it’s $1,000.

- Next, the proceeds for the sale of our Bitcoin is fair market value (FMV) of the property received in exchange for the Bitcoin – in this case, the new car bought. Let’s say the FMV is $35,000, that would be the proceeds amount.

- Because the Bitcoin was acquired on February 1, 2013 and disposed on February 1, 2022, our holding period is more than 365 days, making this a long-term capital gain.

- When we put this all together, the exchange results in a long-term capital gain of $34,000.

Reporting Crypto Taxable Transactions

Currently, brokers and exchanges are not required to report cryptocurrency transactions on 1099-B. Cryptocurrency exchanges in the United States will issue a Form 1099-K for some accounts – generally if the account holder has more than $600 gross volume in a given year. (For calendar years prior to 2022, 1099-K was required if the account holder had more than 200 transactions and $20,000 gross volume in any given year.) 1099-K will report gross receipts from cryptocurrency transactions, but often this is not sufficient for capital gains tax reporting. As mentioned previously, calculating capital gains requires identifying the adjusted basis for the cryptocurrency. This requires good record keeping by the taxpayer.

Cryptocurrency transactions must be reported, no matter if any reporting such as a W-2 or 1099 is received. The IRS puts the onus on the trader to investor to keep accurate records – which can be challenging.

Capital gains from crypto currency are reported on Form 8949. With first in, first out (FIFO) accounting unless specific identification is used.

About That Question on Form 1040…

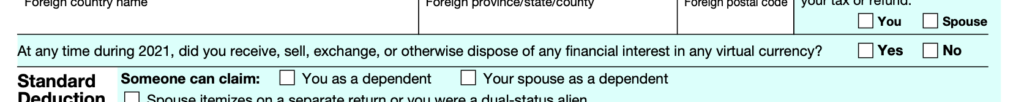

Near the top of Form 1040, taxpayers are now asked “At any time during 2021, did you receive, sell, exchange, or otherwise dispose of any financial interest in any virtual currency?” This clearly puts taxpayers on record whether they had crypto trades. However, the IRS has clarified: taxpayers who only purchased virtual currency with real currency are not obligated to answer “yes” to that question.

Reporting Changes are Coming

The Infrastructure Investment and Jobs Act of Nov. 15, 2021 includes new reporting requirements requiring cryptocurrency exchanges to report cryptocurrency transactions on form 1099-B starting in 2023. More details will be forthcoming as we await IRS guidance and any modification to forms.

Wash Sales on Crypto

Cryptocurrency transactions are currently viewed as intangible property and so wash sale rules do not apply. For now.

Legislation has been proposed which, if passed, will apply wash sale rules to crypto transactions. Time will tell what will come of this proposal.

Section 475 Mark to Market on Crypto

The Section 475 Mark to Market election does not apply to cryptocurrency because it’s neither a security or a commodity. Traders who have elected Sec. 475 will need to maintain necessary records for Form 8949 reporting of any crypto trades.

IRS FAQ FOR VIRTUAL CURRENCIES

Did you know? The IRS has prepared a 46-question online FAQ about virtual currency tax questions. Click here to learn more and find answers to your questions.