CHOOSE HOW YOU WANT TO

MANAGE YOUR TRADER TAXES

Click the option which best describes you…

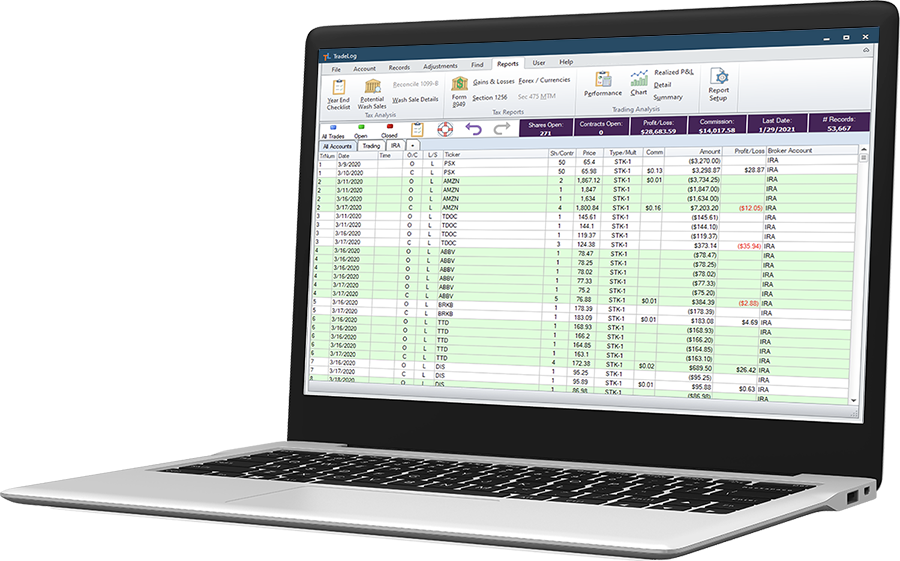

WHAT WE DO

TradeLog helps traders and active investors like you to…

- Manage Your Trade History

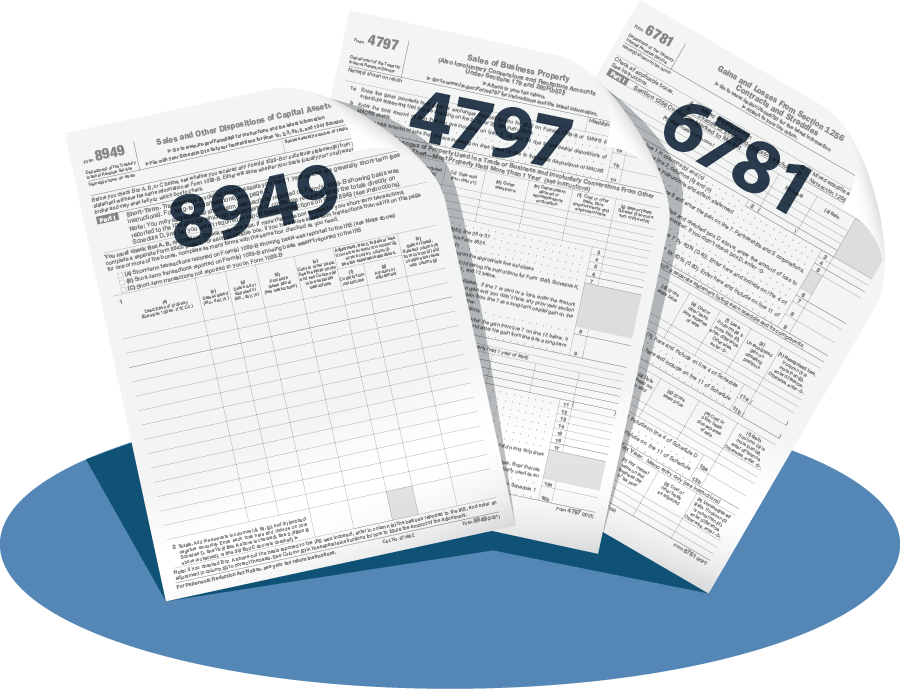

- Prepare IRS-Ready Trader Tax Reports – Like Form 8949

- Reduce Taxable Income

- Take Control of Wash Sales

- Report Sec. 475f Trader Tax Status – Mark-to-Market

- Analyze Performance and Improve Trading

HELP IS ALWAYS ONE CLICK AWAY

TradeLog subscriptions include our highly-praised technical support.

“You folks support your product so well and will have my loyalty for as long as my portfolio lasts – hopefully a lifetime! TradeLog just does, so simply and easily, what Quicken and similar programs and even the best tax prep software simply are not built to do.”

Andre

Guide: Using Tradelog Each Year

Step-by-Step Video Tutorials

Online Support Center

Personal help directly from the TradeLog app

HOW TRADELOG WORKS

STEP 1

Start Your TradeLog Subscription

Sign-up to Get Started for Free for the first 30-days. Once you’ve gotten started, purchase a one-year subscription at the level you require.

STEP 2

Install Securely on Your PC

TradeLog runs on your Windows PC with your data stored securely on your device – or preferred cloud storage. We have Mac users too! – Learn more.

STEP 3

Create One TradeLog File for All Your Broker Accounts

TradeLog can support highly active traders with many thousands of trades per year. You’ll have one TradeLog file for each tax year: that file maintains all your trade history for all your brokerage accounts – including IRAs.

STEP 4

Establish Your Starting Point – One-Time Step

This important one-time step involves some manual entry of any holdings at the start of the first tax year you’re using TradeLog. Our Wizard tool helps you get through the process. Once you establish your start point, TradeLog will do the rest and automatically carry over future years!

STEP 5

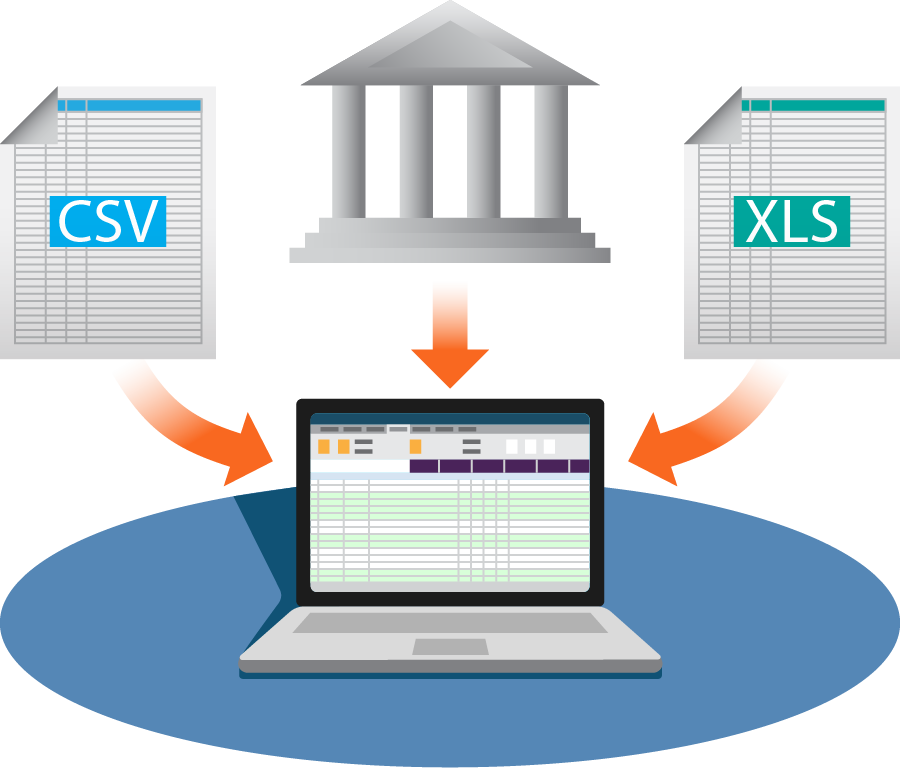

Import Trade History from Your Broker

TradeLog uses your actual trade history to produce accurate, IRS-ready results. TradeLog does not import 1099-B data – Learn Why!

STEP 6

Make Tax Adjustments as Needed

Complex tax adjustments may be required, depending on your situation. TradeLog provides a suite of tools and functions to help make nearly any adjustment required: Corporate Actions, Exercised or Expired Options, Cost Basis Adjustments, Specific Lot Matching, and more.

STEP 7

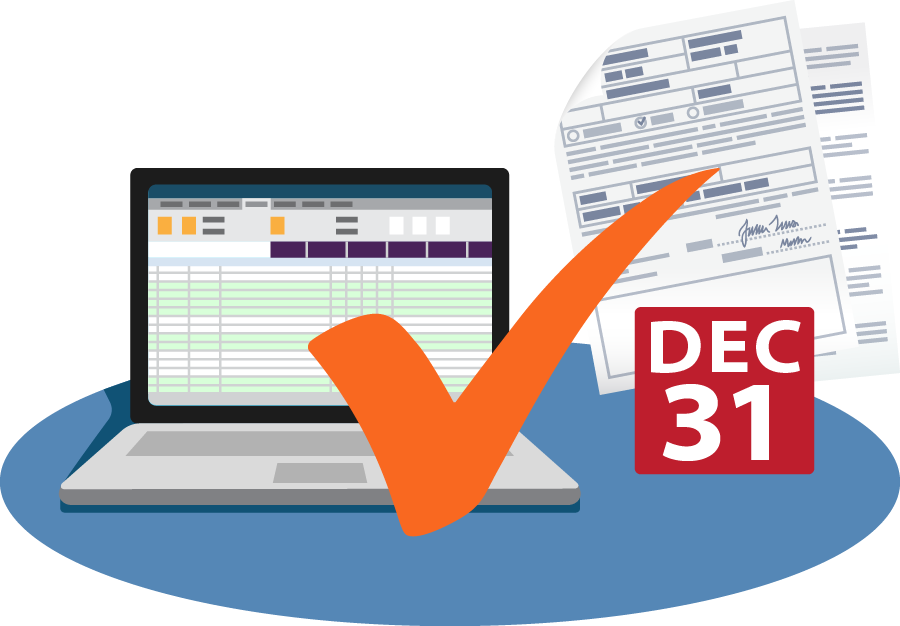

Verify Trade History: Confirm Year-End Holdings

Verifying the accuracy of trade history imported into TradeLog is essential. Confirming Year-End Holdings is a required step before completing finalized reporting. TradeLog will generate a list of year-end holdings, you’ll compare this with your December brokerage statement. Click here to watch how it’s done.

Did you know? Verifying a broker-provided 1099-B can be nearly impossible. Learn more.

STEP 8

Verify Trade History: Reconcile Proceeds with Broker 1099-B

This second verification step helps identify any missing, or miscategorized trades. TradeLog will ask for the gross proceeds number from each broker-provided 1099-B and then compare that total with the gross proceeds TradeLog calculates. This step is required before completing tax year reporting. Click here to watch what’s involved in 1099-B reconciliation.

STEP 9

Generate Tax Reporting for Filing

Once verification and reconciliation is completed you can unlock finalized tax reporting. TradeLog will calculate wash sale adjustments required and create any deferrals that carryover with year-end holdings – your next-year file is automatically created!

STEP 10

Use TradeLog Throughout the Year for Success

Successful traders use TradeLog throughout the year to improve profitability and identify patterns. How will the Performance Report and Charts support your trading?

PRICING

TradeLog offers three product levels to meet the needs of active investors and traders. If you’re new, you’ll start with the 30-Day Free Trial…

TradeLog

INVESTOR

219

- Up to 1,500 Trade Records

- Unlimited Broker Accounts

- 1 File Key Included

Renewal Price for Subsequent Years: $175.20 / Year (20% Savings)*

TradeLog

TRADER

359

- Up to 5,000 Trade Records

- Unlimited Broker Accounts

- 1 File Key Included

- Sec. 475 Marked-to-Market

Renewal Price for Subsequent Years: $287.20 / Year (20% Savings)*

TradeLog

ELITE

459

- Over 5,000 Trade Records

- Unlimited Broker Accounts

- 1 File Key Included

- Sec. 475 Marked-to-Market

Renewal Price for Subsequent Years: $367.20 / Year (20% Savings)*

Have questions about subscriptions, refund policy, or other details? Check out our FAQs.

* Discounted renewal prices apply to eligible renewals only. Discount shown reflects current pricing and is subject to change. Click here to learn more about renewals.

GET STARTED WITH THE FREE TRIAL

Ready to take control of your trader taxes? Take the next steps and start using TradeLog with no commitment.

Register and get your first 30 days free. Register your user info then download and install the app, access our support resources, and set up your TradeLog file.

Import your trades and preview reporting. For an unlimited number of records. Do everything in TradeLog except: copy data; export, save or print reports; or run the End Tax Year function.

Happy with the results? Purchasing the TradeLog subscription level you need will unlock the End Tax Year function allowing you to create finalized reporting.

ADDITIONAL FILE KEYS

Each one-year subscription includes one (1) File Key – required to unlock finalized tax reporting for a TradeLog file. Most TradeLog users do not need to purchase additional File Keys. But, what if…

- You need to complete reporting for multiple past tax years?

- You need to use TradeLog for another taxpayer such as your spouse (filing separately) or an entity you control?

You can purchase additional File Keys anytime for $79 each, as long as you have an active subscription. Login to view your options and pricing.

FEATURES

Tax Features specifically designed for Traders and Active Investors