IRS FORM 1099-B – BROKERAGE REPORTING

A GUIDE FOR TRADERS & ACTIVE INVESTORS

IRS FORM 1099-B – BROKERAGE REPORTING

A GUIDE FOR TRADERS & ACTIVE INVESTORS

If you trade stocks, options, and other securities through a broker, you likely receive Form 1099-B. The purpose of this IRS-required document is for your broker to report cost basis and proceeds of your transactions. Ideally, a taxpayer would simply use their 1099-B for tax reporting; in reality, it’s not that simple. For most traders and active investors, the 1099-B cannot be used for taxpayer reporting.

In this guide, we’ll explain what’s reported in the Form 1099-B and why it’s generally inadequate for traders. If you can’t use your 1099-B, how will you prepare Form 8949 and other necessary tax reports? We’ll explain proven methods for generating accurate, IRS-compliant reporting for traders and investors.

CONTENTS

Form 1099-B Explained

WHAT GETS REPORTED ON FORM 1099-B?

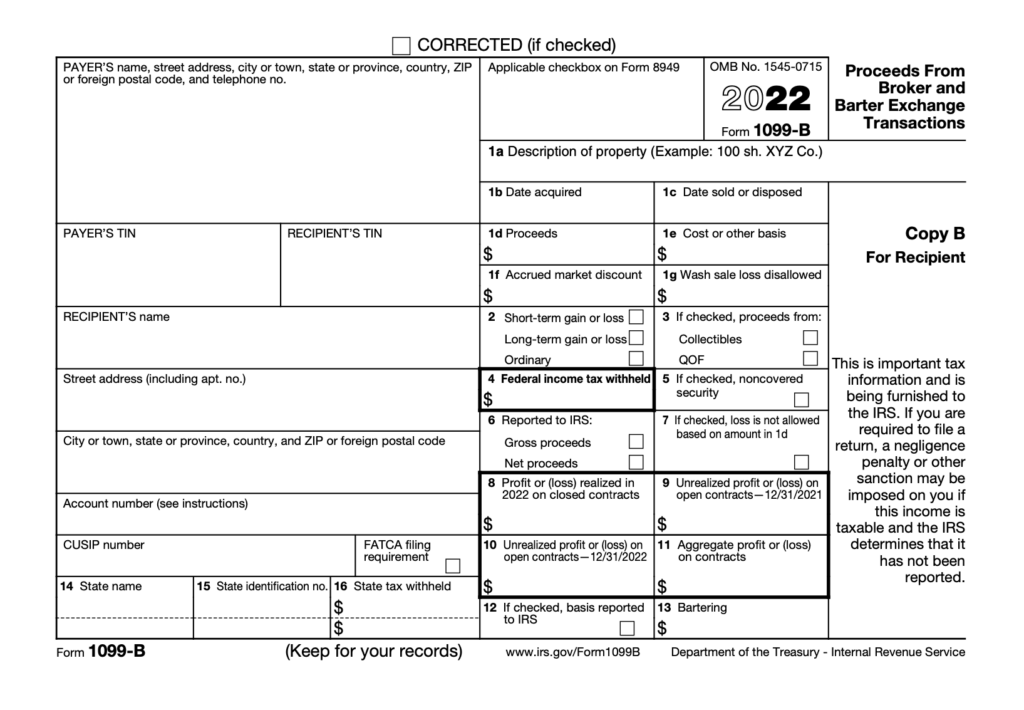

A separate Form 1099-B is provided by a brokerage (or barter exchange) to the IRS and to the taxpayer (client). The actual IRS form 1099-B is a triplicate form containing about 30 different boxes for reporting and looks more like a W-2 provided by employers. However, most traders and investors do not receive their 1099-B in this format because it would entail a separate form for each transaction. Instead, the IRS allows brokers to report 1099-B details in a substitute statement. Often this statement will also include other reporting from the broker such as 1099-INT, 1099-DIV, and 1099-OID.

While the official IRS Form 1099-B looks like this…

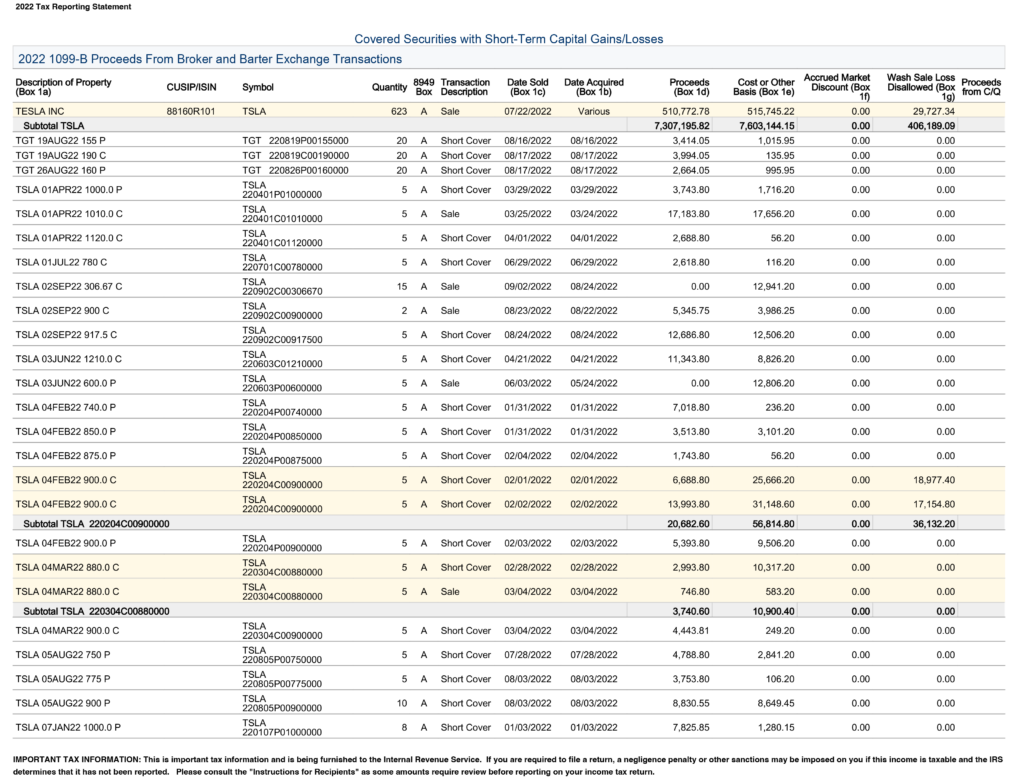

What you receive from a broker will likely be a combined Tax Reporting Statement (or similar titled substitute), which saves you from getting separate forms for each trade. The substitute statement may be many pages long and could look something like this:

Sale Proceeds

In general, brokers report all proceeds for sales of stocks, bonds, commodities, regulated futures contracts, foreign currency contracts, forward contracts, debt instruments, options, and securities futures contracts.

Cost Basis

Brokers are required to report cost basis for covered securities. Covered securities are generally determined based on (1) the type of instrument and (2) the date the security was acquired. In general, the following are covered securities:

| TYPE OF SECURITY: | ACQUIRED ON OR AFTER: |

| Equities (Stocks and Bonds) | January 1, 2011 |

| Mutual Funds, ETFs, and Dividend Reinvestment Plan (DRPs) | January 1, 2012 |

| Options and Less Complex Fixed Income Securities | January 1, 2014 |

| More Complex Fixed Income Securities and Options Issued as Part of a Fixed Income Security | January 1, 2016 |

If a specified security is transferred to an account, it will be treated as covered if the broker receives a transfer statement reporting it as such.

There are exceptions that apply in certain circumstances. And there are also varying interpretations of IRS requirements by some brokers. The IRS provides a more comprehensive list of variables that brokers may use to determine covered or noncovered classification.

LAYOUT OF 1099-B STATEMENTS

As mentioned previously, traders and investors typically receive 1099-B substitute statements. The format and layout of substitute statements can vary greatly depending on the broker. The IRS outlines some rules in Publication 1179 to make those statements more consistent and user-friendly.

The 1099-B statement must segregate trades in up to five categories:

- Short-term transactions in which cost basis is reported to the IRS. – Code A

- Short-term transactions in which cost basis is NOT reported to the IRS. – Code B

- Long-term transactions in which cost basis is reported to the IRS. – Code D

- Long-term transactions in which cost basis is NOT reported to the IRS. – Code E

- Transactions in which cost basis is NOT reported to the IRS and the holding period is unknown. – Code X

In each of the segregated sections, the broker must total sales price and cost basis known for the trades in that section.

Understanding 1099-B Columns and Boxes

1099-B substitute statements typically report key information in columns labeled to correspond with the box numbers on the 1099-B forms.

For each transaction the broker may report:

- Box 1a – Description of Property – this box also includes the number of shares. The IRS gives some standards for the brief description, but brokers may vary greatly. Some brokers use a full description of the stock, some use ticker symbols, some include quantities, some use CUSIP numbers.

- Box 1b – Date Acquired

- For short sales, this is the date you acquired the property to deliver to the broker or lender to close the short sale; typically the trade date of the buy-to-cover trade. See our discussion about reporting short sales on Form 8949 for more details.

- Brokers are allowed to group trades acquired on various dates but sold on the same day. In such cases, they may leave this box/column blank or report “various” on the statement.

- If a security is non-covered (see box 5 below), then the broker is not required to report the date of acquisition.

- Box 1c – Date Sold or Disposed

- For short sales, this is the date you delivered the property to the broker or lender to close the short sale; typically the settlement date of the buy-to-cover trade. See our discussion about reporting short sales on Form 8949 for more details.

- Box 1d – Proceeds – this is the amount received from the sale less any commissions and fees.

- Brokers are allowed to aggregate sales that occurred on the same calendar day for the same stock sold in a single order even though the sale may have been executed in differing lots and prices. This aggregation can make reconciliation with actual trade history very difficult. You may choose to notify your broker not to use this method.

- If the proceeds have been adjusted for option premiums, this will be indicated in box 6.

- Box 1e – Cost or Other Basis – this is adjusted cost basis, not the actual cost basis which may be reported on your trade history.

- If a security is non-covered (see box 5 below), then the broker is not required to report the cost or other basis.

- If the acquisition caused a wash sale which was reported on 1099-B, then the broker will adjust the cost basis by this amount. However, there is no type of indication on the 1099-B if the cost basis has been adjusted by a wash sale and the corresponding quantity of shares or amount. This makes verification of cost basis nearly impossible.

- Brokers are required to account for option premiums in determining the basis of shares acquired by exercising an option.

- Brokers are allowed to aggregate cost basis of shares purchased on the same calendar day for the same stock in a single order even though the trade may have been executed in differing lots and prices. This aggregation can make reconciliation with actual trade history very difficult. You may choose to notify your broker not to use this method.

- Box 1f – Accrued Market Discount

- Box 1g – Wash Sale Loss Disallowed – Wash sales are reported here.

- Brokers are only required to make limited wash sale adjustments, see our discussion of differing wash sale rules in our Wash Sales education topic.

- If a security is non-covered (see box 5 below), then the broker is not required to adjust or report wash sales.

- Box 2 – Type of Gain or Loss (short-term or long-term), generally determined by the holding period of the shares or contracts.

- The IRS requires substitute statement data to be segregated according to the holding period.

- Box 3 – Check if Proceeds Are From Collectibles or From a QOF – there are two checkboxes (or substitute indicators), one for “Collectibles” and the other for “QOF” if reporting a disposition of an interest in a QOF (Qualified Opportunity Fund).

- Box 4 – Federal income tax withheld – backup withholding is reported here.

- Box 5 – Check if a Noncovered Security

- If a security is covered, then the broker must report basis to the IRS. If a security is non-covered, they are not required to report basis to the IRS, but may choose to do so.

- Covered versus non-covered status applies to cost basis reporting requirements and will affect taxpayer Form 8949 reporting. See our explanation about covered securities and Form 8949 categories to understand how trades are classified.

- Brokers who provide substitute statements are required to segregate the 1099-B data based on whether cost basis is reported or not.

- Box 6 – Reported to IRS

Other less common 1099-B boxes / columns are:

- Box 7 – Check if Loss Not Allowed Based on Amount in Box 1d – This box has to do with acquisition of control or substantial change in capital structure. See the 1099-B instructions for more details.

- Boxes 8 to 11 – these boxes are used to report Section 1256 contracts. This information is typically reported in a separate section of the 1099-B substitute statement from brokers.

- Box 13 – Amounts received by a member or client of a barter exchange.

- Boxes 14 – 16 – are used when State taxes are withheld

Additional Reporting Provided on 1099-B Substitute Statements

Brokers may provide additional information in conjunction with the 1099-B substitute statements, some of which may not be reported to the IRS. For example: some brokers also include realized gain/loss reporting either separately, or in conjunction with 1099-B reported details. This additional reporting may be helpful to active traders, but should not be confused with the information actually reported to the IRS.

WHO IS RESPONSIBLE FOR ACCURATE REPORTING OF TRADING GAINS & LOSSES?

The IRS has always, and continues to, place the burden of accurate tax reporting ultimately upon the taxpayer, as is evident by the requirement for brokers to include a reminder to taxpayers that they are ultimately responsible for the accuracy of their tax returns (Pub. 1179 4.3.2).

The Information Reporting Program Advisory Committee noted this problem in their 2009 report to the IRS stating: “Since it is impractical to require that financial institutions be responsible for tracking all possible events and taxpayer-level elections that affect basis, financial institutions should be treated as passive repositories of basis information, rather than guarantors as to its accuracy.” (2009 IRPAC Public Report p. 28).

WHY IS FORM 1099-B INADEQUATE?

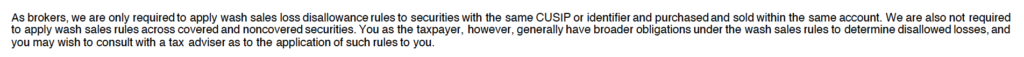

Brokers use a different set of rules when calculating wash sales.

The IRS only requires brokers to adjust for wash sales between identical CUSIP in the same account. This means YOU are responsible for making all other wash sale adjustments, such as between substantially identical securities and contracts, and across all accounts – including IRAs, as required in IRS Publication 550 for taxpayers.

Below is an example of a disclaimer provided by one broker:

Short Sales closed at year may not be reported properly.

Brokers are not required to apply the Constructive Sale Rule when reporting short sales on 1099-B. Brokers generally use the settlement date when closing a short position, however, a few use the trade data when closing a short. Therefore some short sales get reported on the 1099 that should not get reported on Form 8949, or vice versa

Wash Sales on Short Options.

Some brokers report the net gain/loss instead of proceeds for short options. Therefore, the 1099 Gross Sales amount will never reconcile.

Options and ETFs may have different tax treatment than what is reported on 1099.

Tax laws are complex when it come to Options and ETFs, and you cannot rely on your broker 1099-B for proper tax treatment as reported in this Forbes magazine article: Tax Treatment Can Be Tricky With Options and ETFs.

HOW TO USE 1099-B REPORTING

Ideally, taxpayers would be able to take broker-provided 1099-B reporting and use the information to create their Forms 8949 and Schedule D. In fact, this was the ideal of congress when they passed cost-basis reporting legislation. Unfortunately, current 1099-B reporting and regulations are woefully inadequate.

For traders and active investors, the primary reasons they typically cannot use the 1099-B to complete Form 8949 are:

- The 1099-B reports limited wash sale adjustments using different requirements than those for taxpayers.

- There are many documented errors, inconsistencies, and anomalies in 1099-B reporting provided by brokers.

- The 1099-B reporting usually cannot be verified for accuracy – a vital principle in accounting.

Therefore, for most traders and investors, the 1099-B can only be used to provide general information helpful in completing Form 8949 and other tax reporting. 1099-B information can assist with reconciling trade history that is independently used to generate tax reporting according to IRS requirements for the taxpayer, such as with TradeLog.

Reconciling 1099-B

TradeLog software includes a process for reconciling imported trade history with 1099-B gross proceeds. Reconciling proceeds allows taxpayers to verify that their trade history is complete, resulting in accurate Form 8949 reporting. Most active traders are able to verify and reconcile, at least in aggregate, the sale proceeds on the 1099-B.

Reconciling cost basis reported on 1099-B with actual trade history can be impossible in many cases. The information reported on the 1099-B lacks the detail needed in order to reconcile line-by-line with trade history reports or monthly statements. If a taxpayer cannot reconcile 1099-B cost basis with their actual trade history, then they cannot rely on that cost basis for generating accurate Form 8949 reports. For this reason, thousands of active traders, as well as leading trader tax CPAs, use the actual trade history to generate their tax reporting with TradeLog.

BEWARE OF POPULAR TAX SOFTWARE APPLICATIONS THAT RELY SOLELY ON BROKER 1099-B REPORTS

Some popular tax software applications claim to provide the ability to import your broker’s 1099-B data in order to generate Forms 8949 and Schedule D. There are a few facts active traders should be aware of, and questions that result:

- There is no IRS standard for providing 1099-B data in a digital format. Since brokers are not required to report all cost basis information on 1099-B, how do these tax programs generate complete tax reporting?

- Brokers are only required to make limited wash sale adjustments on 1099-B, based on different rules than those that apply to taxpayers. How do these tax programs identify and adjust additional wash sales required by the IRS?

Most popular tax software applications were designed for average Americans – not traders and active investors. Traders deal with some of the most complex IRS reporting requirements and therefore need to use software designed especially for them.

WHY TRADERS AND ACTIVE INVESTORS USE TRADELOG

TradeLog is designed specifically for producing accurate tax reporting for traders and investors. TradeLog utilizes proven methods to generate Form 8949 reports that reconcile with broker-provided 1099-B. Learn more about why active traders use TradeLog.

For over 20 years TradeLog has generated accurate trader tax reporting for Schedule D / Form 8949. TradeLog imports actual trade history from online brokers, then matches and adjusts trades according to IRS rules for capital gains and losses and wash sales – using the rules for taxpayers. TradeLog includes a process for reconciling imported trade history with 1099-B gross proceeds in order to verify trade history and produce accurate Form 8949 reporting.