WASH SALES FOR TRADERS

A GUIDE TO THE IRS WASH SALE RULE AND HOW TRADERS CONTROL THE EFFECTS

WASH SALES FOR TRADERS

A GUIDE TO THE IRS WASH SALE RULE AND HOW TRADERS CONTROL THE EFFECTS

The IRS wash sale rule can be one of the most challenging aspects of tax reporting for traders and active investors. When trading shares or options on the same security over and over again it’s inevitable that you will have hundreds or even thousands of wash sales throughout the year. The IRS requires all these wash sales to be reported and adjusted for on Schedule D Form 8949.

This comprehensive guide to wash sales will help you understand the wash sale rule and how it affects your trading and investing. You’ll also learn how traders take control of wash sales to minimize potentially harmful tax repercussions.

CONTENTS

Wash Sales Explained:

Rules for Taxpayers:

WHAT IS A WASH SALE?

A basic wash sale happens when a security is sold at a loss, then repurchased in a short period of time before or after the loss.

For example: Say a trader owns 500 shares of a security he paid $5,000 for. He sells the shares today for a total proceeds of $4,000, resulting in a $1,000 loss. Tomorrow he plans to repurchase the 500 shares – very likely the price will not be drastically different than today’s. The end result: he will still own 500 shares, but will have generated a $1,000 capital loss. A canny trader may create wash sales to harvest taxable losses and offset his gains to avoid capital gains taxes.

Determining the motive for a wash sale is difficult; an active trader may be in and out of a security frequently and trigger wash sales without any thought of “harvesting losses”. Nonetheless, the IRS established the wash sale rule to prevent anyone from reducing their capital gains by creating wash sales. And the wash sale rule is much broader than our simple example above.

The IRS Wash Sale Rule (IRC Section 1091)

Wash Sales

You cannot deduct losses from sales or trades of stock or securities in a wash sale unless the loss was incurred in the ordinary course of your business as a dealer in stock or securities.

A wash sale occurs when you sell or trade stock or securities at a loss and within 30 days before or after the sale you:

- Buy substantially identical stock or securities,

- Acquire substantially identical stock or securities in a fully taxable trade,

- Acquire a contract or option to buy substantially identical stock or securities, or

- Acquire substantially identical stock for your individual retirement account (IRA) or Roth IRA.

If you sell stock and your spouse or a corporation you control buys substantially identical stock, you also have a wash sale.

If your loss was disallowed because of the wash sale rules, add the disallowed loss to the cost of the new stock or securities (except in (4) above). The result is your basis in the new stock or securities. This adjustment postpones the loss deduction until the disposition of the new stock or securities. Your holding period for the new stock or securities includes the holding period of the stock or securities sold.

What this means in Plain English:

This means that if you close a trade at a loss and then buy back the same, or “substantially” the same equity such as an option on that equity, you cannot take the loss at that time. According to the IRS, the loss now has to move forward and has to be attached to the cost basis of the trade in which you bought back the same equity.

If that trade now ends in a loss and you buy the same equity again, the loss gets moved forward again. This can keep happening indefinitely if you continue to trade the same equity again and again within the 30 day window, each time with a resulting accumulated loss.

Negative Consequences

If the repurchased shares that triggered the wash sale were 1) held open at year end or 2) purchased in January of next tax year, the IRS says that the loss is disallowed for the current tax year and the loss gets moved forward to next tax year, or whatever year you finally dispose of those shares.

You lost the money this year, but the IRS says you cannot take the loss till next year or later!

In addition, the holding period of a trade may change due to a wash sale. For example, if you close a long term holding at a loss and then buy it back within the 30 day window, the loss moves forward to the cost basis of the new trade, and your holding period for the new trade begins on the same day as the holding period of the long term trade. So even if you close the new trade in less than a year, the IRS requires you to report this new trade as a long term gain or loss.

HOW TO CALCULATE WASH SALES

Calculating wash sales is not easy! The IRS expects you to record each and every wash sale throughout the tax year. For those of you who have ever tried to calculate wash sales for an entire year’s worth of trade activity, we don’t need to tell you just how painful this can be.

First you need to identify trades that have been closed at a loss. Then you have to scan backward and forward in time to see if you repurchased the same or “substantially the same” securities within a plus or minus 30 day window.

If you did, then you need to record a wash sale adjustment line on your Schedule D. You also need to adjust the cost basis of the repurchase shares, moving the loss forward or backward to whichever trade triggered the wash sale.

Does all of this sound complicated? It is if you plan on doing this by hand! But it gets even more complicated when you do not repurchase an equal number of shares.

Unequal Shares

It is inevitable that an active trader will occasionally buy back an unequal number of shares after realizing a loss. This is where the wash sale rule starts to really get complicated.

More or less stock bought than sold. If the number of shares of substantially identical stock or securities you buy within 30 days before or after the sale is either more or less than the number of shares you sold, you must determine the particular shares to which the wash sale rules apply. You do this by matching the shares bought with an equal number of the shares sold. Match the shares bought in the same order that you bought them, beginning with the first shares bought. The shares or securities so matched are subject to the wash sale rules.

The Net Effect

What this effectively does is to start dividing up your wash sales by the minimum number of shares bought or sold. A couple of simple examples show this quite clearly:

- You buy 100 shares and sell them at a $200 loss. You then buy back 50 shares within the 30 day window. How much of the $200 loss gets moved forward to the cost basis of the 50 shares? $100 is the right answer (50 sh / 100 sh x $200).

- What if you bought and sold 100 shares at a loss and then bought back 20 shares and then another 80 shares? The wash sale loss on the 100 shares gets split 20/80 with 20% of the loss going to the first buy of 20 shares and the other 80% going to the other 80 shares.

- Now what happens if you had bought and sold 1000 shares at a loss and then bought back 200, then 300, then 100, then 600? What if one or more of the repurchases are sold at a loss and you then buy back a series of shares in unequal numbers?

It starts to get very complicated, like the branches on a tree. Who has time to figure this out manually?

DIFFERENT RULES FOR BROKERAGES THAN FOR TAXPAYERS

Many traders and investors cannot use the 1099-B alone for tax reporting because…

- Brokers are not required to adjust for wash sales that occur across multiple accounts – taxpayers are. Therefore, if you or your spouse have more than one brokerage account, you must calculate wash sales across all accounts that you control.

- If you have an IRA account and a taxable trading account, the 1099-B you receive will not reflect the wash sales that may have occurred because of IRA trades.

- Brokers are not required to calculate wash sales between stock and option trades, or between option and option trades, yet you, the taxpayer, are required to do so.

- The IRS expects you to make any and all necessary adjustments for additional wash sales not reported on the 1099-B.

WASH SALES RULES WITH OPTIONS TRADES

Today’s active trader has many different trading instruments available to him, and many traders often use a combination of these instruments. One such combination is trading both stocks and options on stocks. Buying and selling a certain stock and then buying an option on the same underlying stock may seem to be two separate and distinct transactions, but the IRS may choose to differ when it comes to what triggers a wash sale.

The IRS uses the phrase “substantially identical” when it discusses what triggers a wash sale.

A wash sale occurs when you sell or trade stock or securities at a loss and within 30 days before or after the sale you:

…

3. Acquire a contract or option to buy substantially identical stock or securities, or

What this means for the stock and options trader is that if you take a loss on a stock or an option and then buy back that same stock, or an option on that same stock, whether the option is the same month and strike price or not, you have a wash sale. The same holds true if you close an option position for a loss and then buy the same underlying stock within the 30 day window.

There is no clarification in the tax law as to how far “in or out of the money” the option is, or what month and year the option expires. So TradeLog simply applies this rule as follows: If the underlying stock is the same, then the option is “substantially” the same. For details see our Chart of Wash Sale Triggers section below.

Warning: Brokers do not make these adjustments on your 1099-B because there are Different Rules for Brokers than there are for taxpayers.

WASH SALES IN AN IRA

Special IRS wash sale rules affect active traders and investors who maintain an individual retirement account (IRA) in addition to a trading account. These special rules can have severe consequences on active traders and investors. When a wash sale is triggered by an IRA trade, the loss is permanently disallowed in your taxable account. There are no requirements to file IRS reporting for gains and losses realized in an IRA, nor are wash sale adjustments made within the IRA account alone. However, if you maintain a taxable trading account and an IRA, or Roth IRA, then you are required to adjust for wash sales that occur as a result of trading in all accounts, including the IRA. Your broker does not make these adjustments for you.

How IRA Wash Sales Occur

4. Acquire substantially identical stock for your individual retirement account (IRA) or Roth IRA.

If you close a trade at a loss in a taxable account and, within the 30 day +/- wash sale window, you acquire the same security (or substantially identical security or option contract) in your IRA account, this is considered a wash sale and must be adjusted in your tax reporting.

Notice that this works one way: The loss occurs in the taxable account, and you acquire the new trade in the IRA, which triggers the wash sale. If you generate a loss in your IRA there are no rules for adjusting that loss for wash sales, because it is a non-taxable account.

If your loss was disallowed because of the wash sale rules, add the disallowed loss to the cost of the new stock or securities (except in (4) above). The result is your basis in the new stock or securities. This adjustment postpones the loss deduction until the disposition of the new stock or securities. Your holding period for the new stock or securities includes the holding period of the stock or securities sold.

Notice the part “except in (4) above”. What is the exception?

Normally the cost basis for the security you acquired which triggered the wash sale would be adjusted to include the disallowed wash sale amount. You would therefore capture your loss eventually when you closed out that new position – barring any additional wash sales. However, if a wash sale occurs as a result of an acquisition in your IRA account, the adjustment to cost basis is not made.

This was further clarified by the IRS in Revenue ruling 2008-5. In that ruling the IRS stated: “The loss on the sale of the stock or securities is disallowed under section 1091 of the Code, and the individual’s basis in the IRA or Roth IRA is not increased by virtue of section 1091(d).”

The net result is that the loss in your taxable account is permanently disallowed. You are not allowed to later take your losses by adjusting the cost basis of the IRA trade, the loss is gone!

This rule can have serious consequences for traders and investors. For example: Imagine that you have a net realized loss of $2,500 for the tax year. However, because of wash sales in your IRA account, you have $3,500 in disallowed losses. This means you will have a taxable gain of $1,000 that must be reported to the IRS even though you actually lost money for the year. In normal wash sale situations you would be able to defer the $3,500 to a future tax year, but not so with IRA wash sales – they are permanently disallowed.

Remember: Brokers do not make these adjustments on your 1099-B because there are different rules for brokers than there are for taxpayers.

WASH SALE RULES WHEN SHORT SELLING STOCKS

The IRS wash sale rule is a bit different when it comes to short selling stocks (sell stock short or short sales).

Short sales. The wash sale rules apply to a loss realized on a short sale if you sell, or enter into another short sale of, substantially identical stock or securities within a period beginning 30 days before the date the short sale is complete and ending 30 days after that date.

Therefore, if you cover, or buy back, your short sale shares at a loss and then sell short the same stock again within the 30 day period, you have a wash sale, and the loss becomes part of your future cost basis when you finally cover the short. This is a bit different in the sense that a sale has triggered the wash sale rather than a purchase.

Caution: Some broker 1099-B reports adjust the sales amount rather than the cost basis resulting in a real mess when trying to reconcile cost basis.

WHICH TRADES CAN TRIGGER A WASH SALE?

The following tables show the many possible trade combinations that could trigger a wash sale and that are fully supported by TradeLog software:

Sell at a Loss

| Within 30 days you… | Wash Sale |

|---|---|

| Buy Stock on Same Ticker | |

| Sell Stock Short on Same Ticker | – |

| Buy Call for Same Ticker | |

| Sell Call for Same Ticker | – |

| Buy Put for Same Ticker | – |

| Sell Put for Same Ticker | – |

Sell or Close at a Loss

| Within 30 days you… | Wash Sale |

|---|---|

| Buy Stock on Same Ticker | |

| Sell Stock Short on Same Ticker | – |

| Buy Call for Same Ticker | |

| Sell Call for Same Ticker | – |

| Buy Put for Same Ticker | – |

| Sell Put for Same Ticker | – |

Sell or Close at a Loss

| Within 30 days you… | Wash Sale |

|---|---|

| Buy Stock on Same Ticker | |

| Sell Stock Short on Same Ticker | – |

| Buy Call for Same Ticker | |

| Sell Call for Same Ticker | – |

| Buy Put for Same Ticker | |

| Sell Put for Same Ticker | – |

Buy to Cover at a Loss

| Within 30 days you… | Wash Sale |

|---|---|

| Buy Stock on Same Ticker | |

| Sell Stock Short on Same Ticker | |

| Buy Call for Same Ticker | |

| Sell Call for Same Ticker | |

| Buy Put for Same Ticker | |

| Sell Put for Same Ticker |

Close at a Loss

| Within 30 days you… | Wash Sale |

|---|---|

| Buy Stock on Same Ticker | |

| Sell Stock Short on Same Ticker | |

| Buy Call for Same Ticker | |

| Sell Call for Same Ticker | |

| Buy Put for Same Ticker | |

| Sell Put for Same Ticker |

Close at a Loss

| Within 30 days you… | Wash Sale |

|---|---|

| Buy Stock on Same Ticker | |

| Sell Stock Short on Same Ticker | |

| Buy Call for Same Ticker | |

| Sell Call for Same Ticker | |

| Buy Put for Same Ticker | |

| Sell Put for Same Ticker |

HOW THE WASH SALE RULE EFFECTS ACTIVE TRADERS AND INVESTORS

You might be surprised to learn that…

Most wash sales have absolutely no effect on your year end profit or loss!

Yet, if left unchecked, the wash sale rule can have disastrous results at year end. Some of your losses may be disallowed for the current tax year and end up being deferred to a later year, thereby increasing your taxable income in the current year. This is what is known as a wash sale deferral.

Real Life Account:

A trader client repeatedly bought and sold anywhere from 400 to 1000 shares of the same stock over a period of several months and never stopped trading this particular stock for more than 30 days. Some trades were profitable, but most were not. His profitable trades amounted to $7,023. On December 29th he liquidated all of his shares and took a $117,045 loss. Therefore his net loss at year end totaled $110,022. He could have stopped right then and there, but for some reason he did not!

What do you think would happen if he repurchased this same stock on January 2nd?

You guessed it, his entire loss of $117,045 was disallowed and he ended up having a net gain of $7,023 for the year, He had an actual net loss of $110,022 on that one stock for the year, but because of not paying attention to the IRS wash sale rule, he instead had to pay taxes on a gain of $7,023!!

In that example, if they continue to trade the same stock without letup, and continues to accrue additional losses, then those deferred losses may continue to be deferred – until they either their gains are high enough to absorb the losses, or they stop trading the stock for 31 days.

Another trader did just that. He ended up with losses from one year being deferred to the next year, and the next year, up to 3 years later when he finally stopped trading the losing stock. All the while he paid taxes on the gains he made on his winning trades. Now, in both cases, their losses were finally realized, but who wants to defer losses to some tax year in the future? It can be a trader’s worst nightmare to have to pay taxes on money that they did not really make!

Can you see just how damaging this IRS rule can be for some active traders?

There are two situations where the wash sale rule may affect your year end profit or loss:

- If you sell at a loss in December and then buy it back in January

If you sell a stock at a loss in December and then buy it back in January (within the 30 day window), the loss is disallowed for the current tax year and has to be moved forward, and can only be realized in whatever year you finally dispose of the shares that you bought in January. The same holds when you close a short sale at a loss in December and then enter into another short sale in January (within the 30 day window). - If you hold shares open at year end that have accumulated wash sales

If you lose on a trade any time during the year and then buy back the same security within the 30 day window and you hold these shares open at year end, the entire loss is disallowed for the current tax year. The losses now have to be moved forward with the open position, and can only be realized in whatever year that you finally dispose of the shares that you repurchased.

In either case, the loss is disallowed for the current tax year and needs to be deferred to a future tax year. In order to illustrate how this can affect your bottom line, consider the following scenarios:

- You sell 1000 shares on December 4 and take a loss of $3,200.00. If you buy back shares of that same stock, or enter into an option trade on that same stock anytime up to January 4 of the next year, all or part of your $3,200.00 loss is disallowed for the 2013 tax year and must be deferred to a later year according to the IRS wash sale rule. What this means is that you really lost this amount in December, but you cannot take the loss until you finally sell those repurchase shares in some later year.

- You sell 1000 shares on March 15 and take a loss of $3,200.00. If you buy back shares of that same stock, or enter into an option trade on that same stock within the 30 day window and hold these shares open at year end, all or part of your $3,200.00 loss is disallowed for the tax year and must be deferred to a later year according to the IRS wash sale rule. What this means is that you really lost this amount very early in the year, but you cannot take the loss until you finally sell those repurchase shares in some later year.

WASH SALE DEFERRAL EXAMPLE

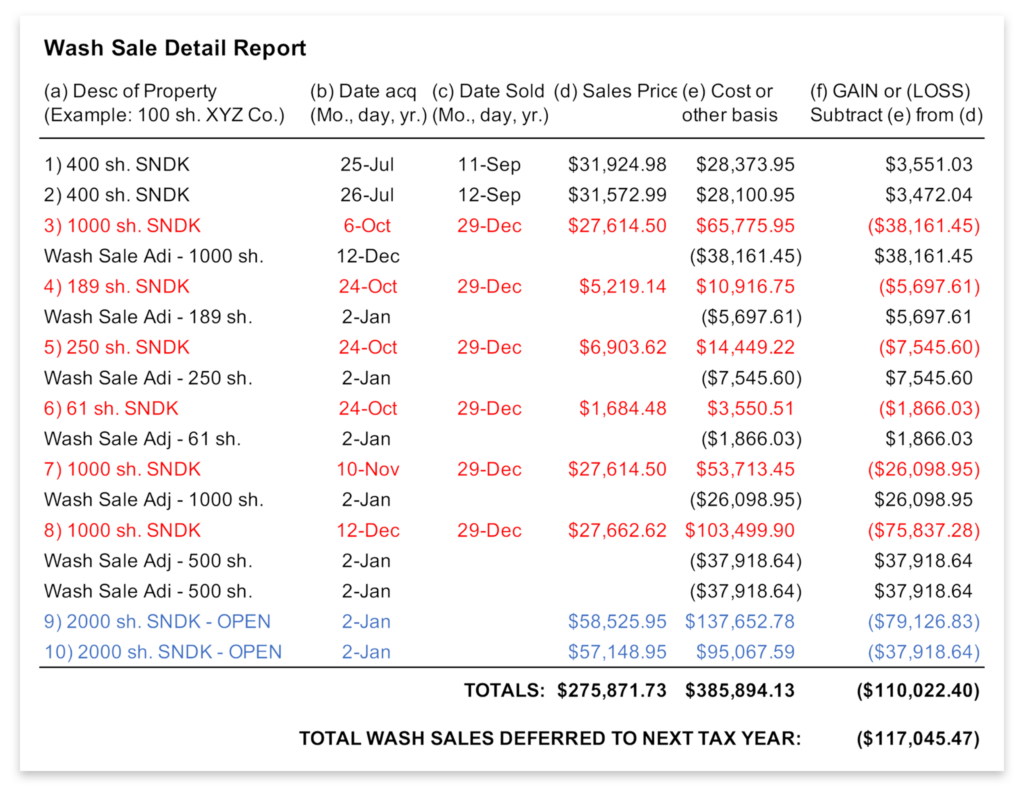

Below are the wash sale deferral details for the real life account we shared earlier in this guide. This example shows how a string of wash sales can accumulate and defer, altering taxable gains and losses.

The report is from a standard TradeLog Wash Sale Detail Report which shows the trades that caused the wash sale deferral, even though these trades were made in the next tax year (trades 9 & 10). Within the report, you can always determine which trade triggered the wash sale by examining the date of the wash sale. For example, the wash sale after trade #3 has a date of December 12. Therefore, trade #8 with its date acquired being December 12 is the repurchase trade that actually triggered the wash sale. You can also identify when a wash sale is being deferred, as its date is greater than 12/31 of the current tax year, or the trade that triggered the wash sale was held open at year end.

- Please notice that on December 29 he proceeded to liquidate 3500 shares of SNDK all at a loss (trades 3-8 highlighted in red).

- Each of these trades generated a string of wash sales that eventually moved forward and attached themselves to the 4000 shares purchased on January 2 (trades 9 & 10 highlighted in blue). A total of $117,045.47 worth of losses were “disallowed” due to the IRS wash rule.

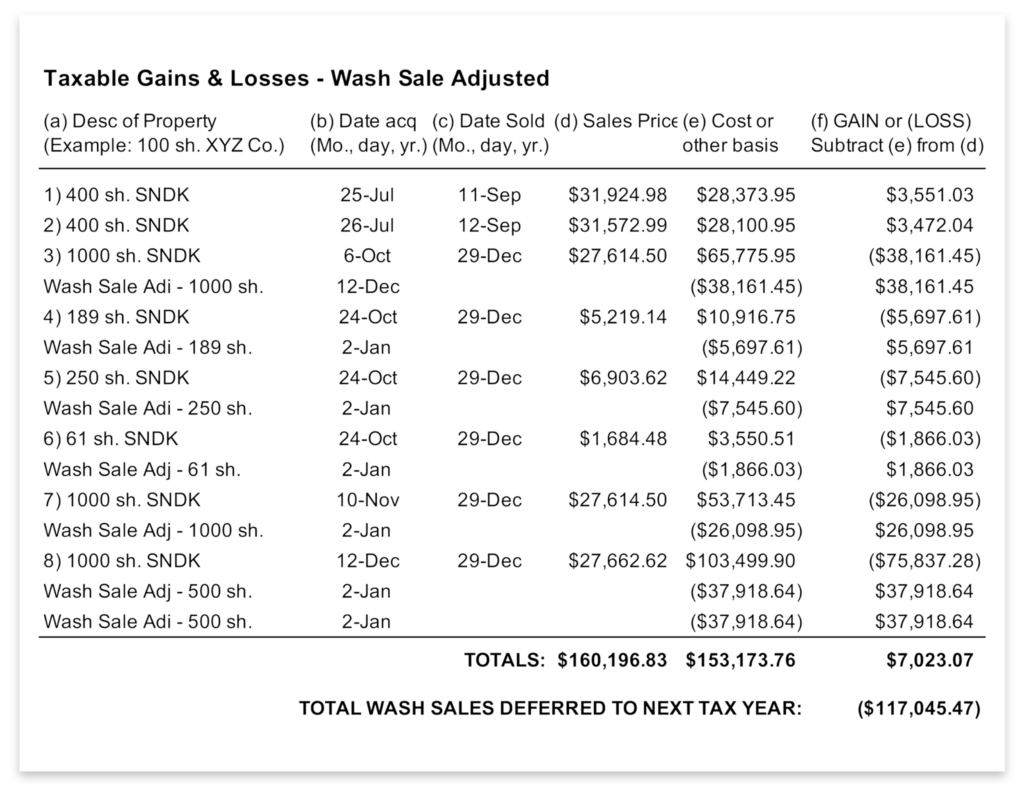

- Therefore, an actual loss of ($110,022.40) became a short term capital gain for the tax year in the amount of $7,023.07.

- Taxes had to be paid on this amount even though he actually lost $110,022 for the year.

The actual Gains & Losses report as attached to his Schedule D and filed with his tax return is shown below:

This is by no means an isolated example as we see data files with wash sale deferrals like this all the time. However, using TradeLog software, you can spot these in December and take corrective action before it is too late.

HOW TO AVOID WASH SALES

As an active trader, you may not be able to avoid each and every wash sale that may come along due to the fact that you are in and out of trades frequently and some losses are inevitable. Yet, you really don’t have to worry too much about the net effect of wash sales until year end.

Here are three simple rules to keep in mind that can greatly reduce your risk of having some or all of your losses disallowed for the current tax year and deferred to a later tax year:

- If you take losses in December, don’t buy back the same stock for 31 days.

If you take losses in any stock in December, be sure NOT to repurchase the same stock (or an option on that stock) for a period of 31 days. If you do, your losses will be deferred to a later tax year. You won’t permanently lose the loss, it will just move forward and you will have a greater tax consequence in the current year. - Close out any open positions at year end that have accumulated wash sale losses.

If you have any open positions at year end that have wash sale losses attached to them, these wash losses must be deferred to a later tax year. To avoid this unpleasant situation, close the open position that has a large wash sale loss attached to it and do not trade this stock again for 31 days. - Avoid trading the same security in your taxable and non-taxable IRA accounts.

Because of the severe nature of IRA wash sale adjustments, it is often best to avoid any situation where an IRA wash sale could be triggered. Which means not trading the same security (or options on that security) in both your accounts. If you must trade the same security, be especially alert to losses that occur in your taxable account and avoid any new opening trades for 30 days in the IRA.

Tip: Use your TradeLog software to run the Potential Wash Sales Report, especially in December and January, to help identify these situations and take the appropriate action.

ADVICE FOR ACTIVE TRADERS

Many web resources advise you to stop trading a stock for 31 days any time a loss is incurred to avoid triggering a wash sale adjustment. However, as explained above this is really unnecessary.

The only critical time period is in the months of December and January where losses realized in December, or wash sale losses attached to open positions can turn around and bite you! But if you have the right tools, you can easily spot these conditions, take the necessary action, and lessen your tax bite come April 15.

So keep trading those stocks and options if you think you can make a profit! Take your losses as they come. Stop trading them when you realize that you are no longer profitable in that equity, or if you are about to take a big tax hit at year end.

If you absolutely, positively must trade that losing stock or want to hang on to open shares with a large wash sale loss attached to them, be sure to have a good reason for doing so and be aware of the tax consequences of your trading. The more knowledge that you have at year end, the better equipped you are to make such a decision.

HOW TO ACCURATELY ADJUST FOR WASH SALES

TradeLog Software adjusts for wash sales as outlined by Publication 550 – across all accounts including IRAs, across stocks and options and options and options. It then makes the necessary adjustments to cost basis and calculates gains and losses according to the IRS rules for taxpayers.

Brokerage 1099-B reports have different wash sale reporting requirements, make limited wash sale adjustments across stocks only in a single account, and are not adjusted according to requirements for Schedule D Form 8949 filing.

For over a decade, TradeLog has been helping active traders and investors to better understand and make adjustments for wash sales on their Schedule D reporting. Learn more and get started using TradeLog for free.